Avalanche vs the world

Chains like Polygon and Binance Smart Chain had great timing and managed to get a lot of traction “for free” simply because Ethereum did…

Chains like Polygon and Binance Smart Chain had great timing and managed to get a lot of traction “for free” simply because Ethereum did not have the capacity to meet demand. However, what does the future look like when chains like Avalanche exist, and/or Ethereum manages to scale?

Cryptocurrency 101

It’s easy to get overwhelmed with the thousands of 3 letter ticker symbols that each represent a different coin. It’s worse because you can find yourself viewing charts and reading various articles about the latest and greatest coin, but it’s much more important to understand why blockchains exist.

Imagine a textbook on any subject; They are usually hundreds of pages long, contain dense material, and certain subjects even require multiple textbooks before you can grasp an expert level of knowledge. The information can’t be reduced to a few sentences, or even a few pages. This applies to cryptocurrency as well. However, by zooming out and answering the question of why, we’re better able to predict which chains are better able to perform their function as blockchains.

The Internet is basically a protocol (a set of rules) that transfers packets of data. Those packets of data can be anything from a simple text message, or a rich web app, or streaming HD video. All the useful things we use today are built on TOP of the protocol we know as “the internet”.

So where does cryptocurrency fit in? Similar to the Internet, cryptocurrency is a protocol for transferring value.

In a similar fashion, we will see people build apps on top of blockchains that people will find useful. Today, we already have DeFi (Decentralized Finance) Platforms that enable transparent financial infrastructure to everyone. These kinds of instruments are normally exclusive to the privileged or wealthy.

In the same way that the Internet democratized information, cryptocurrency will democratize money on a global scale. That’s a huge deal.

Blockchain weaknesses

You can once again get overwhelmed trying to wrap your head around how a blockchain works, but it’s not required in order to utilize services or web3 platforms. However, you should know it’s a fancy term for what is essentially a database with one major design difference. Instead of performance, a blockchain is able to provide trust. We can trust the results that are recorded because

- they are immutable (permanent)

- mathematically provable (using cryptography)

- they follow a set of rules ( enforced by running the same software)

- game theory (by trying to cheat, you lose)

Basically, getting strangers to “agree” to something will inherently take longer than one person making up all the rules. This is why blockchains will always be slower than a traditional database.

Scaling Blockchains

Historically, the biggest problem that popular chains face is the lack of scale. This just means that there is too much demand and the blockchain isn’t performant enough to keep up. Typically this is where fees come in; Think of a bus, with limited seating. This represents a “block” in the “block chain” (a literal chain of blocks written by nodes). If each node operator is a bus driver, they can only fit so many people but what happens when you have a customer who is willing to pay $10 to get on the bus instead of the usual fare?

Naturally, the bus driver(s) are incentivized to take the highest bidder every time, and this will result in people (transactions) that have to wait on the sidelines until there are no more people who will overpay to get on the bus. This has led to transactions being stuck for hours at a time, sometimes even days before getting confirmed into the blockchain. This also results in ridiculously high fees sometimes costing hundreds of dollars for a single transaction (more data results in higher fees).

Long term fee spikes are simply unacceptable because they price out a significant portion of the globe. It’s also disruptive if a business relies on a confirmed transaction before settlement. Can you imagine having to wait a couple of days after you checkout your shopping cart? What if the price of the token falls drastically during that period?

TPS (Transactions per second)

People often confuse this metric as one of speed, but that’s not accurate. It’s more like capacity. Using a first person shooter game as an analogy, every gamer wants fps (frames per second) to an extent, but the real competitive advantage is in latency. Given an equal level of skill among players, having unlimited FPS will absolutely get crushed against having 1ms of latency to the server.

Unfortunately when it comes to blockchains, TPS is not a black and white metric. Certain chains will make trade offs to achieve a higher TPS and market themselves as “faster”. Others (like Solana) will cheat the metric by putting their consensus messaging on-chain and counting those as transactions. Which gets us into vertical scaling

Vertical Scaling

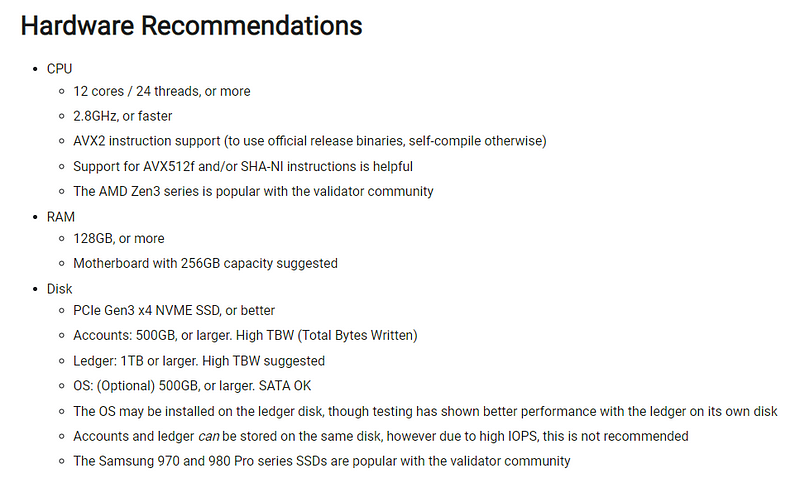

Lets look at Ethereum’s 12~16 TPS figure as an example. If every single node today were to swap out their hardware for the top of the line, the TPS would increase. The problem with vertical scaling is that it becomes very easy to reach a limit where the problem cannot be solved even if you have unlimited money. Even with billions of dollars, you can’t produce the next generation of hardware overnight.

Solana has taken the shortcut of requiring very expensive hardware in order to run a node so that they can boast higher TPS metrics. Even running the best hardware, they managed to DDoS themselves with too much transactions to compute and has experienced network failure multiple times already.

Horizontal Scaling

Scaling horizontally includes methods like sidechains, layer 2s, and sharding. Avalanche’s approach is called Subnets and allows you to create your own chain while getting the best “engine” for free. Basically instead of upgrading the hardware on the main nodes, you add services to “absorb” some of the load away from the main chain.

A layer 2 will “checkpoint” onto the main chain it’s built upon and basically create a hash of transactions as the data to imprint on the base chain. The problem with this approach is if you build on top of an L2, you are dependent on the main chain as well, but it’s also out of your control. For example, if there is significant network congestion , it may prove difficult to get your checkpoints in a timely manner which can be a security hazard.

Layer 2s are marketed as being “complementary” or “beneficial” to the base layer chain; This is false, they compete directly with the base layer, especially if the layer 2 has their own token. Liquidity is also split as it is often required to bridge your assets from chain to chain. Bridging is the process of using specialized contracts and nodes in order to lock assets on one chain and basically “print” the same quantity of asset on the destination chain. There is a significant level of risk and historically there have been catastrophic hacks on bridges resulting in hundreds of millions of dollars being stolen.

The biggest dealbreaker of L2s is that they are inherently centralized. Decentralization is also not a black and white thing, there’s degrees of decentralization. However, we can safely assume that the more decentralized a chain is, the more people are likely to invest liquidity, build apps, and transact on this chain compared to a centralized one. You will not be able to find a decentralized layer 2 because they do not exist.

Historical crypto trends

At first, there was Bitcoin (BTC). That was the only player in town. People wanted to create their own version of bitcoin and this was possible because the code is opensource. This allows people to fork and make changes. People were incentivized to create their own coins and the money followed. Even forking required a lot of energy and expertise because you still had to have an understanding of how it all worked underneath.

Years later, Ethereum was created and it ran a different VM (virtual machine) than bitcoin, which enabled the use of smart contracts. The ERC20 specification was created and this basically made it easy to create a token. Significantly easier than creating your own coin, a token could be created in 5 minutes or less. The money followed again, and the new hype was launching a new token for every project.

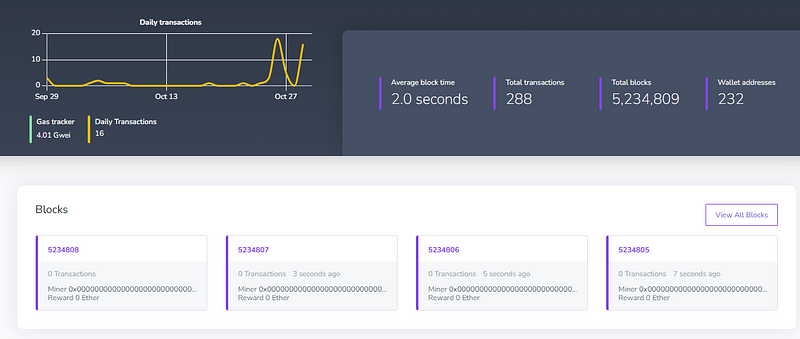

Today, it’s clear that no single chain is able to support all the traffic in the world. Horizontal scaling is a common theme but the amount of energy and expertise required to launch your own app-chain makes it inaccessible. Once launching your own app-chain can be done in minutes, we can reasonably expect another surge of projects and money injection. If only that were possible today…

oh wait, it is.

A multi-chain world

The promise of a web3 world cannot be achieved until there is sufficient interoperability. In the past, people were bullish about the idea of something like DentaCoin. There would be a blockchain dedicated towards the dental industry. Sounds fine on paper, but the project has not gone anywhere and will end up like all the other dead chains due to merit.

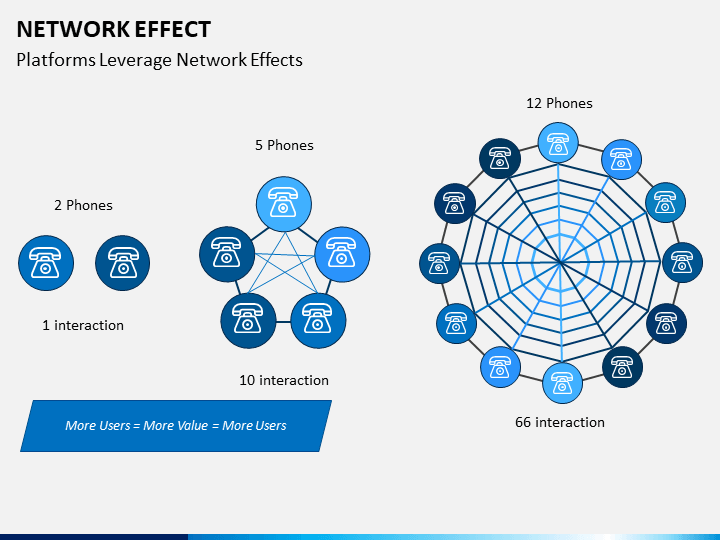

Why doesn’t this approach work? The problem with creating your own standalone chain is just that; It stands alone. Any activity you manage to muster on your chain will be in it’s own bubble. Any value generated only benefits a single chain rather than an ecosystem.

Today, we have some interoperability within the EVM chains, which require bridges. It’s not great, but it has shown that increased liquidity among multiple chains provides real value to more users, which in part attracts more users to participate. The biggest problem with this approach, (which subnets solve) is that you can ONLY participate with other EVM chains. Subnets allow for the communication between an infinite number of Virtual Machines, and unlike certain solutions (Polkadot), there is no limit on the number of subnets that can exist.

Lets look at the web2 gaming world today. You can have massive in game economies like World of Warcraft, or Diablo, and there are markets for cosmetics in games like League of Legends, Valorant, Dota, etc. For the most part, theses are all like standalone blockchains in the way they lack a network effect.

Imagine the value generated from one game could persist even outside of that game. Whether it be by trading one in-game token for another, or if a cosmetic can be transferred to another, this is a level of value and ownership that is only possible in web3. Another interesting aspect of gaming is the “play to earn” concept, where users are rewarded and in certain cases can even make a living by playing the games they enjoy.

avalanche is best suited to support a rich web3 gaming metaverse

Comparisons

These are the major concerns when deciding which platform to build on.

- Security

- Speed

- Customizability

- Tokenomics

Security

Bitcoin introduced the concept of decentralized consensus. It’s often referred to as Nakamoto consensus, and can be quantified at 51%. This means that if an attacker is able to obtain more than 51% of the total network hashpower, they are able to “cheat” and do things like duplicate coins, reverse transactions, and basically make the ledger untrustworthy.

There are other considerations to security, but to keep it simple, the further you go up a stack (base layer to layer 2 for example), the weaker the foundation and the more dependencies there are that are out of your control. It’s like having a foundation on sand, versus concrete. As a general rule of thumb, you want to be building on a base layer. The only reason some sidechain/l2 solutions managed to grow was their base layer was maxed out. However with subnets offering infinite scaling, sidechain solutions are in trouble.

One of the most amazing things about Avalanche’s consensus model is that the security can also be quantified, and the security threshold is 80%. Making it hands down the most secure protocol without making trade offs. The cherry on top is that all subnets get this “engine” for free.

Speed

As we mentioned prior, the latency is the time to measure, not the TPS.

- Optimistic rollups: 1 week

- Bitcoin: 60 mins

- Ethereum 2.0: 6 mins

- Cardano: 5 mins

- Polkadot: 60 secs (60 mins to external chains)

- Elrond: 51 secs

- Solana: 13 secs

- Avalanche: less than 1 second

Due to the innovative Avalanche consensus protocol, AVAX is able to achieve the fastest finality. It should also be mentioned that a subnet to subnet transaction takes less than 2 seconds, making it the fastest multi-chain solution as well.

Customizability

Cosmos only provides you with an SDK, and it is not an integrated part of their protocol. The EVM compatibility is not great and IBC in general has to pass headers back and forth as well as the unique messages on top to each node, which causes extra overhead.

Polkadot has a limited number of parachains (100), and is not cheap, nor has protocol messaging. You have to “raise” funds every election cycle in order to keep a parachain, which is not a great experience for people who want to build something permanent. Thus, polkadot cannot support enterprise usecases. Polkadot also goes through their primary chain in order to do cross transfers; this creates overhead because all the messaging goes through a single chokepoint and has rotating validators. This bottlenecks how they communicate with each other, and bottlenecks how they partition validators across other chains.

Polygon edge also has a cap on supernets, and requires bridges to be setup on each supernet in order for cross chain transfers. They only support EVM, and you are required to use a new token as the native gas token. There is a static reward scheme for validators, and to get premium tooling costs $400k (in todays prices). Supernets are permssioned-only meaning users cannot deploy their own contracts on networks, only the owner can.

Avalanche subnets offers the most customizability hands down. Subnets can be permissioned or permissionless. The reward schemes can be customized to your liking; A merit/market based incentive structure would naturally offer the most security. The native token can be AVAX or your own. Enterprise use cases are supported and subnets allow you the flexibility to do things like

“you can’t trade this asset for this period of time”,

“you cant transfer this to specific entities’,

“only certain entities can view these transactions”.

Subnets support all VMs, making it the most futureproof solution.

This one requires a bit more emphasis. If there is a brand new blockchain with an original virtual machine that offers the ability to do xyz, then that means a subnet could be created with the same VM and benefit from the performance, decentralization, low fees and customization Avalanche offers.

Tokenomics

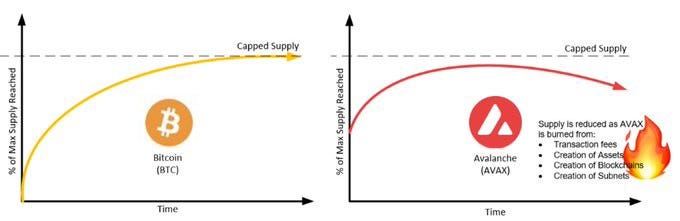

AVAX has a finite cap, making it scarce. The emissions curve is modeled to follow the same as Bitcoin’s 4 year halving schedule. The gas fees from transactions are burned, further reducing supply.

Staking rewards depend on what % of the current avax in circulation is locked up, but currently sits around 9% APY which is pretty lucrative. Typically with staking, you simply lock up your coins and have no further utility until the locking period ends. However with liquid staking you are able to stake your AVAX, and receive a token that represents your staked amount (sAVAX for example), and continue to use that token to earn additional APY on top.

There are currently over 700 (https://snowpeer.io/) subnets on testnet. Each subnet requires a minimum of 2,000 AVAX to be locked up in order to validate your own subnet. If everyone wants to run their own subnet, It’s pretty easy to imagine what will happen with the price as demand increases but supply decreases.

Conclusion

A multi-chain world is inevitable, and the one that is able to grow the largest network effect will be the winner. An important consideration is that subnets have always been on the roadmap since the release of the Avalanche whitepaper. However, there are those who are suddenly rushing to copy the idea (polygon supernets). Do you want to build on top of the team who has brought some of the biggest innovations to the crypto space, as well as having the best technology? Or would you make a long term bet on a “me too” chain.