DeFi Loan Strats

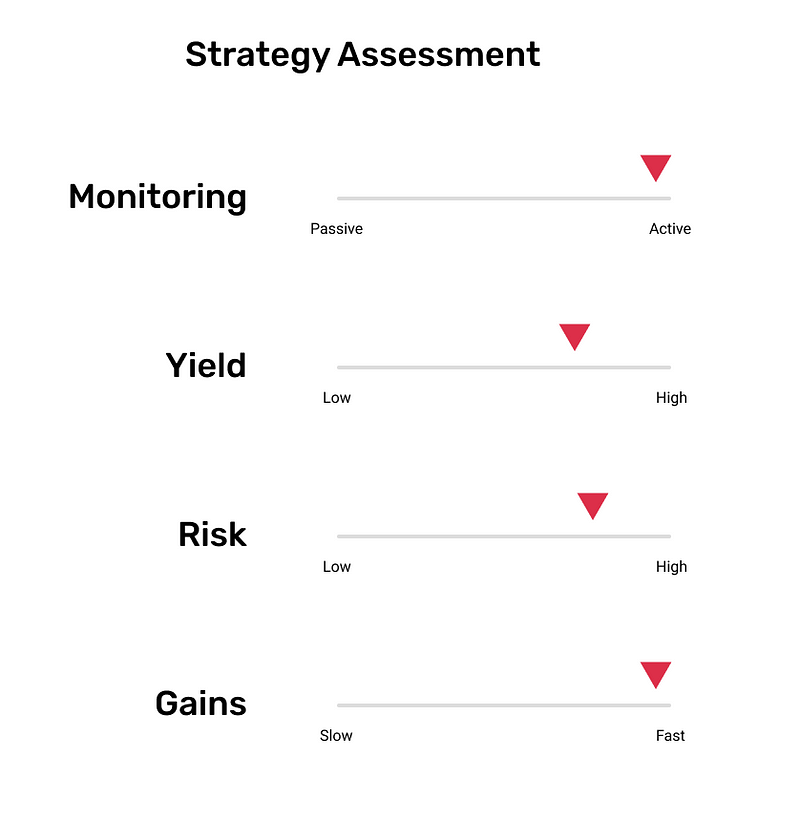

In the world of DeFi, there are tons and tons of different strategies on how to make more money and naturally, they follow a spectrum of…

In the world of DeFi, there are tons and tons of different strategies on how to make more money and naturally, they follow a spectrum of risk. In this article we’ll be covering some of the more risky, higher reward strategies you can use when partaking in crypto loans.

However, that was a more “passive” strategy and as a result the potential returns are not going to be quite as high. The trade off is that there is less risk involved with that method.

Here’s an example of what we will try to accomplish with $10,000 in borrowed money.

- Borrow $10,000

- swap that $10,000 for a different token

- sell that token for $15,000

- pay back the $10,000 loan

- walk away with $5,000

Sounds pretty straight forward and obvious but why do we need to do this with borrowed money? To understand the benefits, let’s first take a look back at a pre-defi world.

Pre-DeFi

Before Decentralized exchanges were a thing, you had to rely on a centralized exchange to swap your crypto. The downsides are

- Must provide KYC information (ID, selfie, real name, etc.)

- account can be frozen

- trading is a taxable event

- lose access to your funds

- took 3~7 days in between actions

In the earlier days, people speculated on tokens and the only way to “cash out” was to sell said token on a centralized exchange for Fiat (USD, EUR, etc). Due to legacy banking infrastructure, you would have to wait for the exchange to wire you the money into your bank account and that would often take 5 days on average. So what would happen if there were an opportunity to buy back in or to sell even higher? You were out of luck because there’s nothing you can do but wait for the wire to clear.

Today, In avalanche there are plenty of stablecoins and they can be swapped back and forth within seconds. This is largely what makes the loaning strategies possible today.

What is a stablecoin?

A stablecoin (USDC.e, DAI.e, etc) represents $1 in USD. It is pegged to value by an algorithm or by a trusted company (ie: coinbase). Okay, but why is that relevant to DeFi? Basically, you get the ability to “cash out” almost immediately, and without any of the cons of the pre-defi method. A stablecoin also holds it’s value and is not volatile.

- no one can prevent your transaction from happening

- no one can freeze your wallet/funds

- the swap transaction takes seconds

- non-taxable event

- stronger privacy

That all sounds good, so lets go into the two main strategies.

What to do when you think AVAX will go up

Let’s say the starting price of AVAX is $100, and you think it will hit $150 soon.

- Borrow $10,000 in USDC.e (or your preferred stablecoin)

- Immediately swap that stablecoin for $10,000 in AVAX

- wait for price to hit your target ($150)

- sell AVAX for USDC.e ($15,000 worth)

- pay back the $10,000 USDC.e

- keep the change ($5,000)

What to do when you think AVAX will go down

Here, we will assume a starting price of $150, and that it will hit $100.

- Borrow $10,000 in AVAX ( 66~ AVAX )

- Immediately swap for $10,000 in USDC.e

- wait for price to hit your target ($100)

- you still owe 66 AVAX, but now each AVAX is 50% cheaper

- sell USDC.e for AVAX (100 AVAX)

- pay back the 66 AVAX

- keep the change (34~ AVAX)

So why do we bother doing this with borrowed money? If you understand the tokenomics of AVAX, you know that they become more and more valuable/scarce as time goes on so you want to increase your holdings as much as possible. If you were to try to time the stablecoining strategy with your main stash, the likely result would be you would lose on some attempts and end up with fewer AVAX compared to if you took no action. This is a foolish plan especially when there is a safer method to be able to protect your main stash and still try to stablecoin. Depositing your main stash into a loaning platform like Benqi or AAVE allows you to stay long 100% AVAX , while still having play money to perform these kind of strategies.

This is a very powerful feature of loaning, and may take a couple attempts before fully understanding.

The ability to remain long on your main stash is something that shouldn’t be underestimated.

Closing thoughts

Everyone has a different spectrum of risk; If you make a successful play, the safer plan of action is to take your earnings (in AVAX) and deposit into your main stash. This gives you a bit more of a buffer to borrow larger amounts of money. Alternatively, you can “double down” on your next stable coin attempt for more profits than you would have from solely the borrowed amount.