Understanding DEXes vs Bond Curve Contracts: What New Crypto Users Should Know

Cryptocurrencies have opened up a world of decentralized finance (DeFi), but navigating the various trading systems can be confusing for newcomers. Today, we'll explore Decentralized Exchanges (DEXes) with Automated Market Makers (AMMs) and the recently popularized Bond Curve Contracts.

What is a DEX?

The purpose of DeFi is to democratize financial infrastructure for the world, in a safer, transparent manner. The idea is we no longer need to trust middle-men, and instead replace their function with publicly visible code on the blockchain. The Decentralized Exchange (DEX) is the most popular platform because it allows users to trade tokens without intermediaries. Here are some of the advantages.

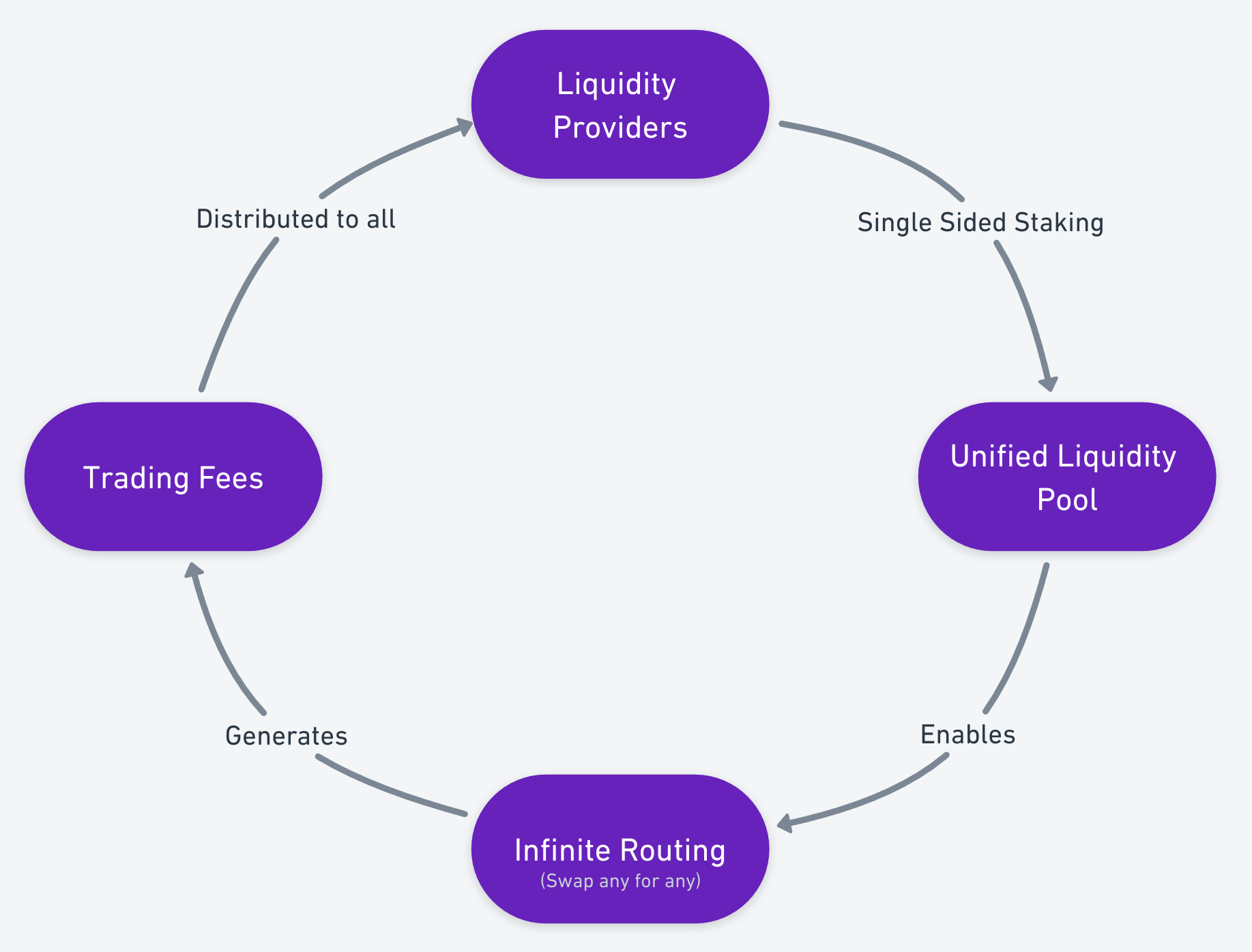

- Dynamic Pricing: DEX/AMM models use algorithms to adjust prices based on the ratio of assets in liquidity pools. This helps ensure fair market rates as supply and demand fluctuate.

- Liquidity Pools: Users can become liquidity providers by depositing assets into pools. They earn rewards from all trades in that pool, creating an incentive for participation.

What are bond curve contracts?

Bond curves are much simpler trading models; But simple isn't always better for the user. Here are some of their limitations:

- Vulnerability to Exploitation: The predictable pricing of bond curves can be exploited by sophisticated trading bots, meaning your $100 worth of tokens becomes worth $5 after they pump and dump on you.

- Low Market Cap: Each new contract essentially starts from 0 and requires a massive amount of trades before there is sufficient supply to migrate onto a DEX. This results in over 90% failed tokens and limits participation to traders who only like low market cap tokens.

- Limited Liquidity: Bond curves don't have the flexible liquidity pool systems found in DEXes. This can result in less efficient markets, higher costs for traders, and it usually only allows for one token to be used to buy/sell

Why DEXes May Be Safer

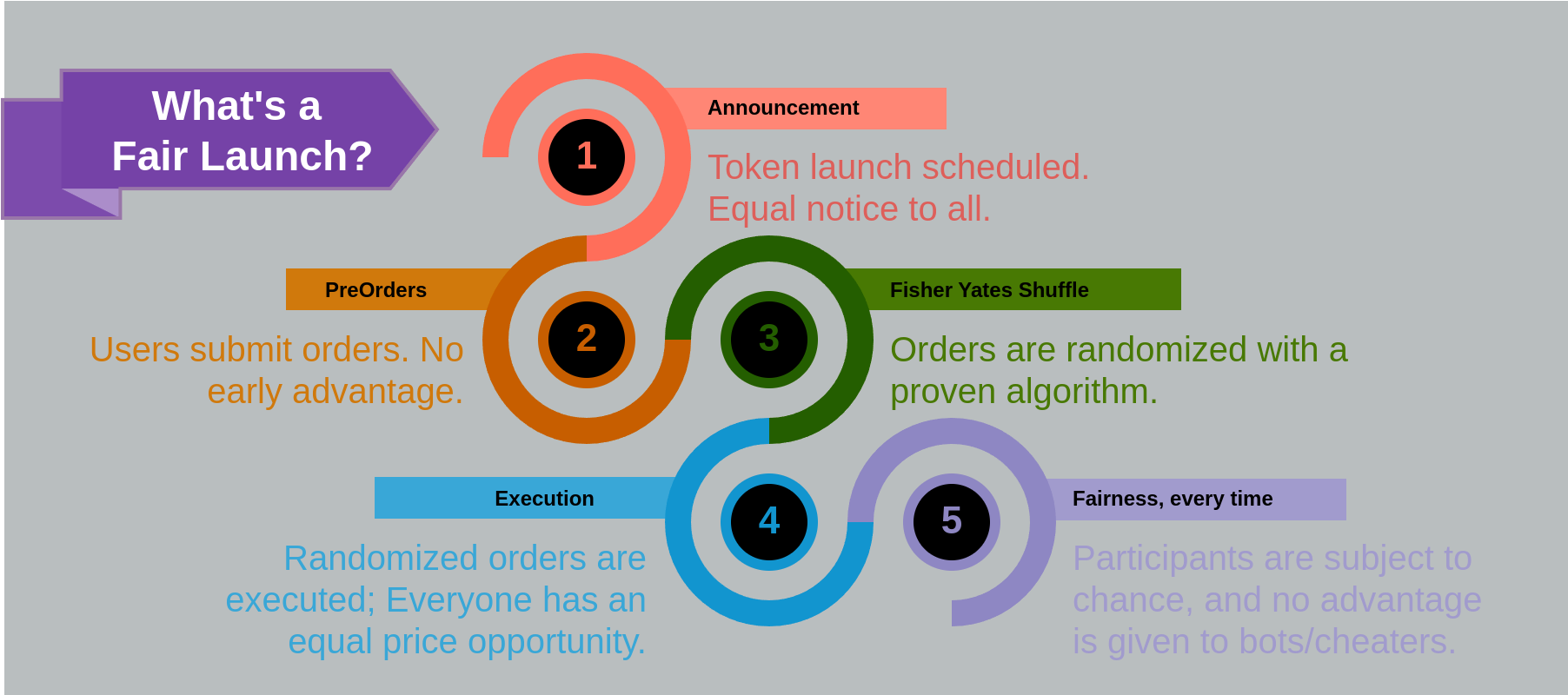

Front running is an exploit that happens on tokens that are about to launch. Bots begin listening in on the token contract and as soon as the addLiquidity() event is triggered, it is possible to swap that token. Typically, bots will listen in and place their orders in faster than a human can, and as soon as the price moves up, the bots will dump their initial supply on the users.

However, there are solutions to this type of exploit. Datnoid for example, has a fair launch system to equalize the opportunities.

If for some reason, this security is not preferred, Datnoid also offers a first come first served launch option that rewards the best price quotes for those who place their orders soonest.

Remember, all crypto trading carries inherent risks. Always invest responsibly and never risk more than you can afford to lose.